- The competition between China and the United States, specifically over technology and trade. The economies of China and the US will begin recovering in earnest in 2022, and this growth will spur new innovation and competition between these two powers.

- The integration of new, highly advanced technology into industry. New tech like artificial intelligence, quantum computing, blockchain, virtual reality and drones have the potential to totally upend the global economy.

- The digitalisation of companies. The pandemic encouraged many businesses to transition to work from home or develop some other way of going contactless.

- The growth of digital assets, like cryptocurrency.

- The environmental movement, which will transform global industries and production by changing them to fit into more eco-friendly models. Decarbonisation and green energy will play an increasingly large role in the post-pandemic energy sector.

- The growing demand for socially conscious business practices by consumers and investors.

- The ageing global population. Global industries will have to stay innovative while also catering to an increasingly older consumer base.

- The economic and political consequences of an expanding wealth gap – such as growing welfare programmes, a rise in Socialist political policies.

In The Accounts

A course for beginners wanting to understand accounts for work, play and investing

Tuesday, 20 May 2025

STARMER IS NOT IN GOVERNMENT. HE IS JUST MANAGING BETWEEN SUPERIOR POWERS

Tuesday, 8 October 2024

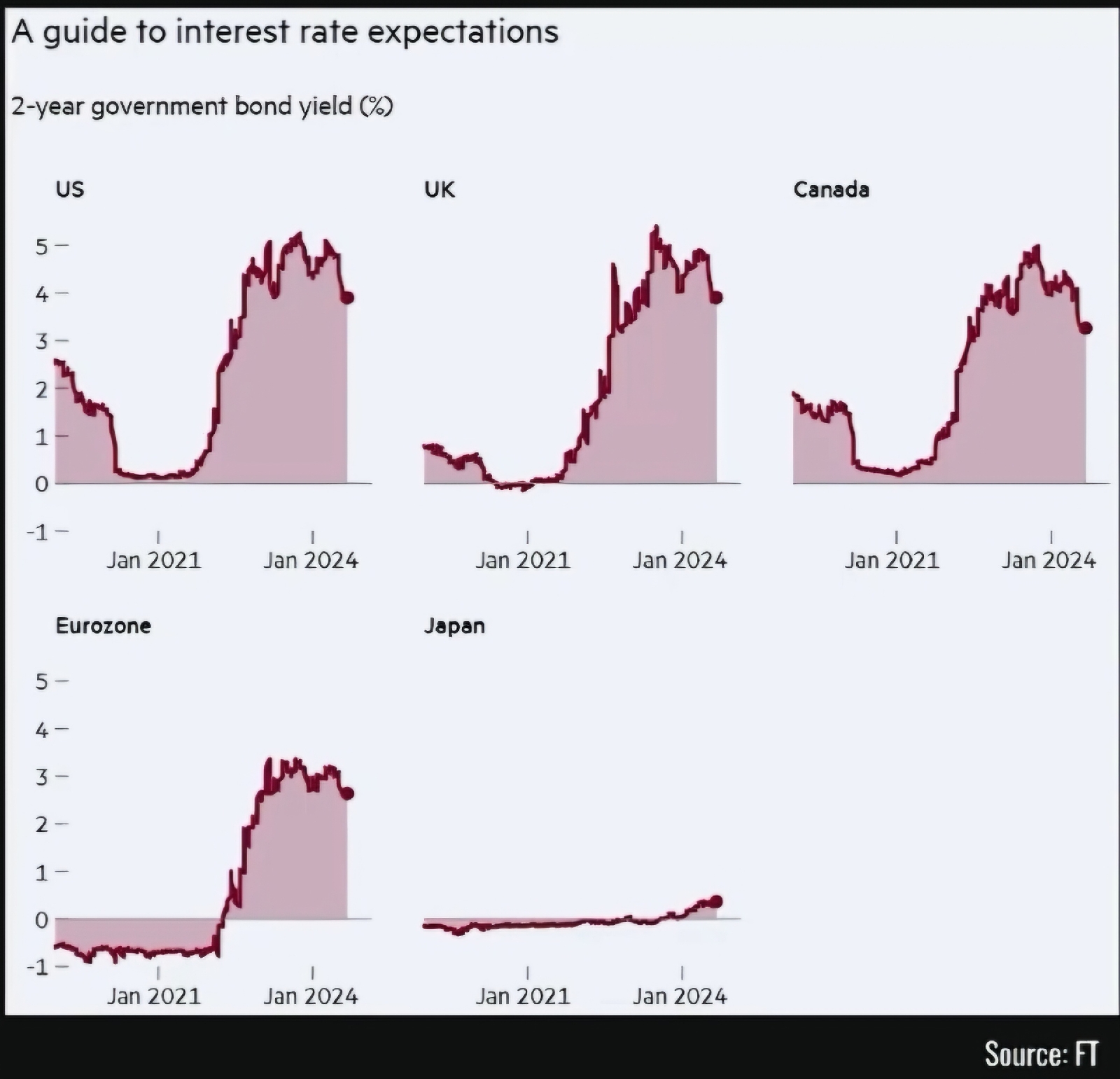

WHAT IS A BALANCE SHEET RECESSION

Monday, 16 September 2024

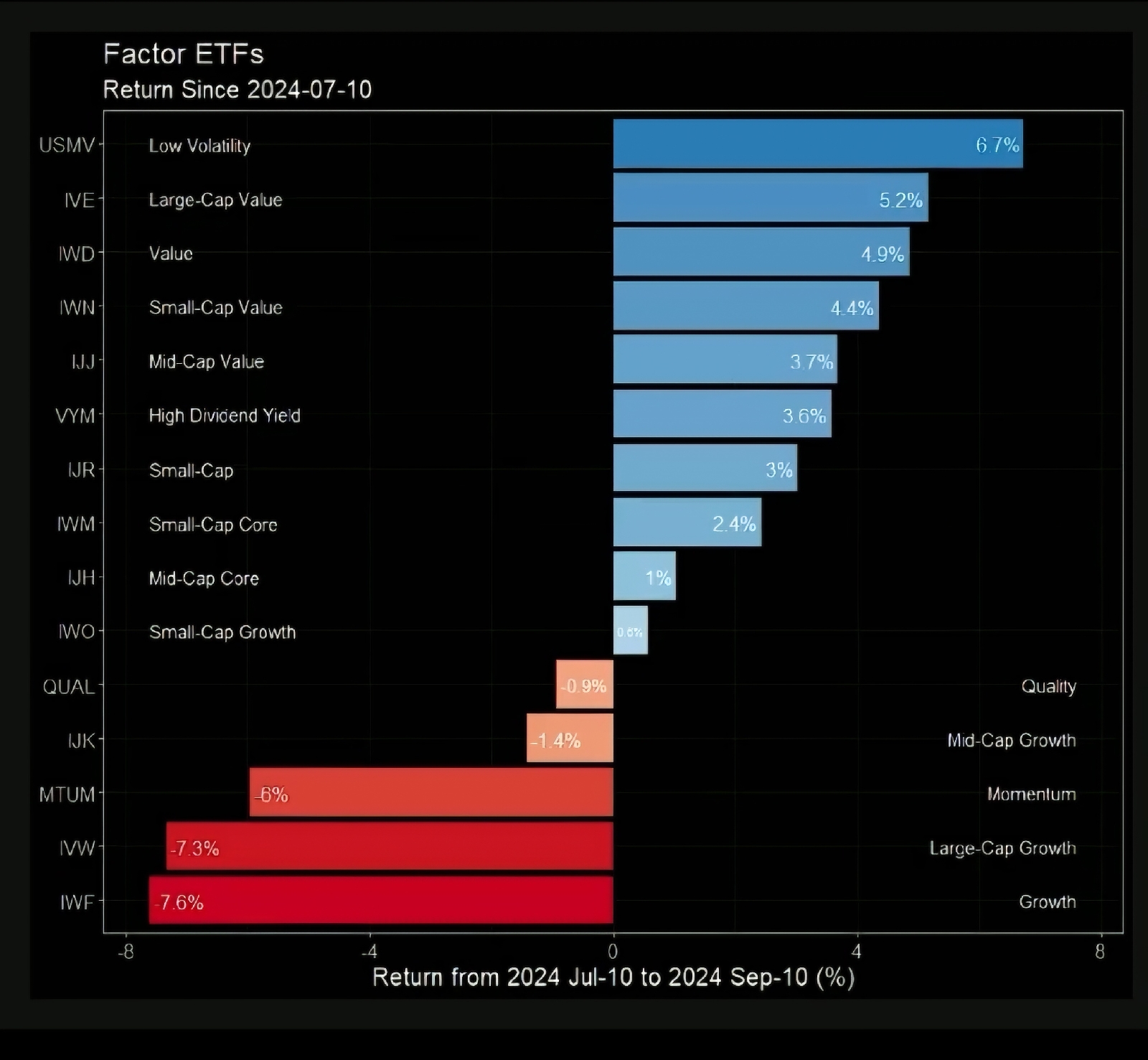

THE GREAT STOCK MARKET ROTATION

Friday, 26 July 2024

WHY THE DONBASS BELONGS TO RUSSIA

Monday, 27 November 2023

LOY KRATONG

Sunday, 19 November 2023

FOR A WRITTEN CONSTITUTION TO MAKE OUR SYSTEM SANE AGAIN

Tuesday, 2 August 2022

THE UNITED SELF

Tuesday, 30 November 2021

THE FRANCE ZEMMOUR SEEKS TO SAVE (RHETORICAL TECHNIQUES)

https://youtu.be/k8IGBDK1BH8

He appears speaking behind a huge mike and in front of ancient books stacked on shelves, reminding us of De Gaulle's wartime calls for resistance (Appeal of June 18 by General de Gaulle).

He begins by telling us his mission, which is to save France from decline "so that our daughters don't have to wear headscarves and our sons don't have to be submissive"."I understood that no politician would have the courage to save the country from the tragic fate that awaited it. I understood that all these supposedly competent people were mostly helpless [...] That in all parties, they were content with reforms while time is running out. It is no longer time to reform France, but to save it.

I therefore decided to stand for the presidential election."

If you want to know more about how he uses repetition (1), insistence (2), the transfer of allegiance from "you" to "we" (3), mirroring (4), tirades of accumulation (5), assonance (a rhythm of similar sounds) (6) dramatic background music (7):

1. Repetition

Do you remember the country you knew in your childhood? Do you remember the country your parents described to you? Do you remember the country you find in the movies?

2. Accumulation, insistence

our lifestyles, our traditions, our language, our conversations, our controversies on history or fashion, our taste for literature and gastronomy

Joan of Arc, Pasteur, de Gaulle, Molière or even Notre Dame and village churches: all these figures are associated with the word "country". This word is repeated 24 times in two minutes.

The powerful, the elites, the well-meaning, journalists, politicians, academics , sociologists, trade unionists, the well-meaning religious authorities as well.

The country of Joan of Arc and Louis XIV [..] of knights and gentes dames [..] fables of La Fontaine, characters of Molière and verses of Racine

3. From "you" to "we" - pushing you to side with him

You walk [..] you look at your screens [...] you take subways [...] you wait for your daughter or your son at the end of school ...

We must give back the power to the people, take it back from minorities that oppress the majority.

4. Mirroring

You have not left your country, but it is as if your country has left you. You are exiles from within.

You were despised [...] but you understood that it was they who were baiting you, it was they who were harming you

5. Tirade

The French people have been intimidated, paralyzed, indoctrinated, made to feel guilty

For a thousand years, we have been one of the powers that have written the history of the world. We will be worthy of our ancestors. We will not allow ourselves to be dominated, vassalized, conquered, colonized. We will not let ourselves be replaced

6. Assonance

"S" and "P"

7. Dramatic music background

Rather ironic this as the music is not from French culture, it is the adagio of the 7th Symphony of the German composer Ludwig van Beethoven, also used in The speech of a king, a British made film.

is.gd/mMZ3Wz

8. Black n white photos

He contrasts a past glorious France, using black and white images of black and white of Jean Gabin, Alain Delon, Brigitte Bardot, Johnny Halliday, Charles Aznavour, Georges Brassens, Barbara; with scenes of violence and social unrest from today.

Friday, 26 November 2021

THE WINNER FROM THE 7-YEAR RETAIL ENERGY WARS

COMPANY RESULTS

Revenues up 6%, customers up 0.5%, total services (energy, broadband, mobile) up a fraction. Earnings down a fraction (settlement with Ofgem cost £1m). Mostly from TEP's supply contract with e.on (elec and gas). Interim dividend 27p no change yielding 1.27% at 1446p. Then add expected 30p Final would give 3.94% forward yield.

THE STORY

The little profit utilities make goes out in divis and repairing or upgrading the network. SSE or NG as examples.

But govt thought utility customers needed better deals so the utility companies were put into competition with new intermediaries who were buying wholesale and selling retail. Competition pushed pricing into the short term with switching and even utilities Co.s themselves making special offers.

All well and good? Except that now offers began to appear at below cost, with new customers being walked up to a more sustainable price.

After complaints, the regulator again intervened, thinking a price cap reviewed bi-annually would solve this.

Along came sky-high gas prices (quite why is another fascinating story) and these new intermediate suppliers came tumbling down like nine pins.

So much for govt ingerence. "Good luck with that", you'd have advised them!

LAST MAN STANDING

Where did that leave Telecom Plus? It had another strategy, not short-term switch-and-burn, a strategy it initiated 20 years ago.

Its supply side is to buy bulk long term eg the e.on contract.

Its customer side is to offer all services in one convenient bill, perhaps more expensive than if you managed things yourself, but you sign up and have nothing more to trouble you. It pulls in new customers not with screaming headline advertising, but through a network of 40,000 "partners", ie word-of-mouth.

In the current crisis, this strategy has left it as "last man standing".

TO BUY OR NOT TO BUY

This means an unexciting but competently run company providing a long-term investor with a stable income (divi) stream for their money. Not of much interest to the trader I wouldn't think. Buy, hold, put on DRIPS.

Thursday, 25 November 2021

WHY IS THE UK SO ATTRACTIVE TO MIGRANTS, LEGAL AND ILLEGAL?

To question the assumptions in the question: is the UK that attractive? Turkey has three million Syrians, Australia is 10% non-White, France has over a quarter of live births to plenty both born outside the country, the States is overrun with Mexicans. So ask instead why are so many people on the hoof. It isn't, then, our wonderful culture of tolerance and welcome, nor our lax border patrols, is more the desperate push factors of I.possi ility to survive in the Sahel or Iraq and the pull of paid work and a future in the developed world

It's not just the African continental shelf pushi g into Europe, itsall the people aboard to. At least China and S E Asia isn't trying to move in..

"We're over here because you were over there". Our colonial past, language that they'll have learnt in school, family and community ties.

Then there's availability of work. Not welfare benefits except for legit. migrants, I wouldn't think. These young men want to work. France is a very racist country, UK locals welcome in the illegals - there's no movement opposing them, which I find strange as I'd be out there with my rifle.

And the hard left political elite genuinely want to break society apart and admit the migration wave whole, I cannot understand why ... what has happened to those who believe in nation, culture and family? Even though massive and unplanned immigration puts us all into third world lifestyles (housing, welfare, education, infrastructure).

Maybe decent people have given up and frankly the Woke have so confused most people and glued their mouths shut lest they be labelled white racist supremacist.

As you say intl liberal capitalists are complicit, but so is the political class (govts) as population is just what you need to increase GDP of a country's economy (not that individuals benefit of course) and reduce debt.

And remember that the power of a nation is the multiple of the population number times the wealth, putting it simply.

Who wants to take up cudgels and lose their job and be mocked and for nothing as you'll never make headway, the Indians have the wagons completely surrounded, IT'S TOO LATE MATE. Just get on with it, replace our culture, allah wakbah humbug.

Not sure either that the UK has such a generous asylum regime, to judge by UK well down the intl list. But that's for legals. The trouble is the coven of lawyers that stop the illegals being flown back, and the cost.

I said many years ago we would mine the Caucuses and send out fighter jets to Harry and strafe retreating illegals. There is no other answer to flows caused by poverty and climate change and brutal regimes.

Wednesday, 24 November 2021

LASTING CHANGE RESULTING FROM THE PANDEMIC

Tuesday, 23 November 2021

IS IT JOHNSON OR IS IT THE GREAT RESET?

If there is a problem, is it Boris? Or is it his in-tray?

This is supposedly the age of the great reset, the end of the modern world as we knew it. The issues Johnson must manage are not in the manifesto because the manifesto is hardly relevent. Instead, far more sinister existential issues have emerged.

Look at what won Johnson his 80 seat majority on and ask how relevent or priority are these commitments today, has he really broken his promises or have they been submerged, overtaken, in The Great Reset?

THE MANIFESTO

*Health - up NHS spending from £181b (£50 a week for every one of us) to £215b (£60), build 40 hospitals over 10 years, recruit 50,000 nurses and enough GPS to offer 50m more appointments, sort out Social Care once and for all.

*Environment - insulate the built environment £9b, build offshore wind farms, end plastic waste, I don't recall any controversies around COP or Greta.

*Brexit - leave the EU and get new Trade Agreement with EU, legislate for workers’ rights, environmental protections and consumer rights, replace CAP with a system based on “public money for public goods”, new office for environmental protection.I don't recall any controversies around fishing or NIP trade and customs.

*Immigration - Australian-style points-based immigration system, immigrants must contribute to the NHS and must pay in first to receive their benefits, NHS Visa to fast track entry for qualified who speak good English, seek out“leaders in their field” to come and work in the UK.

*Education and early years - Increase spending on schools to level up, support school heads and teachers on discipline, more “alternative provision” schools for excluded children, “arts premium” funding, raise teachers’ starting salaries to £30,000., better child care system and affordable childcare.

*Economy and Skills - fund operations from taxation, but borrow to invest in infrastructure, public debt to be lower than last parliament, public sector net investment not to exceed 3% of GDP and adjust change programs if debt interest exceeds 6% of revenue, priority to the environment in the next budget, £3bn skills fund for education and training.

*Tax, pay and benefits - raise NI threshold to £9,500 and ultimately to £12,500, respect the triple lock”, no increase in income tax, NI or VAT, a new deal for regenerating towns, continue the rollout of universal credit itwh psecial attention for the most vulnerable.

THE RESET

* The great warming of our planet (COP26_V.2).

* The great replacement of our civilisation, from without (how to defend our borders from survival migrations, from cyber attack, from The Virus Wars) and within (from Woke inclusivity, the Sharia takeover).

* The great and global UK comeback (to redirect our trade flows, to link the anglo-saxon world in defence against the Middle Kingdom).

CONCLUSION

These must be the most complex threats this country, the world, has ever faced imo. They arrive like hand grenades and Boris is expected to find all the pins by Christmas.

These are the very dark cloud banks through which must shine a PM's usual manifesto commitments - are Johnson's promises (above) broken? Or are they out of date?

No wonder there are calls for World Government, a USSWorld of 200 states. Seems unlikely to work.

Monday, 22 November 2021

MICRO AGGRESSIONS

Already a pb in English, in the French language - which is more heavily gendered - this Woke recognition of identity is a real pb.

Example

In Fr, you have il or elle and there isn't a neutral "it".

To not hurt feelings of the sensitive, you say "iel". This recognises that the person is not just a biological unit, but also has many other dimensions of which gender, not sex, is one.

But now what ... do you say "iel est belle", or "iel est beau"? Or do you need new forms for all adjectives?

When you consider that 22% of youth 18-24 do not identify as il or elle, according to survets, that's a problem (that maybe they'll grow out of?).

But is this the real concern? Or are people, especially younger voters, more concerned with the great warming up of our planet and, possibly older voters, the great replacement of our civilisation by another?

There is so much fundamentally structuring items in our lives that are changing, that perhaps we can say, with data and without drama, in agreement with SAGE and scientists more widely, that this epoch, call it the modern world, is now finished and we must find something else.

Now, it is not just about daunting changes in the grammaire, not just about respecting individuals whatever their background, now we have to find ways to deal with end of the modern world and help the planet and our species to survive, find ways to secure our borders and deal with migratory flows, find ways to identify unambiguously who we are and protect our civilisation, while keeping good relations with neighbours and others, on whom we depend, in an interlinked world, without breaking social cohesion at home.