1. Introduction: Understanding Stock Market Rotation

• Global stock markets have seen little overall movement recently.

• Beneath this calm surface, significant shifts are happening within specific sectors.

• Rotation refers to some sectors rising while others fall, despite overall market stability.

2. Example of Rotation in Action

• Over the past two decades, growth stocks, especially in tech, have outperformed value stocks.

• Two ETFs (IVW for growth, IVE for value) illustrate how growth has generally led over the long term.

• Recently, this trend began to reverse, particularly after July 11th, 2023, with US inflation data publication.

3. The Shift in Sectors

• Post-inflation data, tech stocks began to falter, while value stocks, like real estate and utilities, surged.

• This was a reaction to changing interest rate expectations, favouring sectors more sensitive to interest rates and the cost of money.

4. Why Rotation is Happening Now

• US mega-cap tech stocks have been significantly overvalued.

• Investors overpaid for stocks driven by narratives like AI, while fundamentals are starting to reassert themselves.

5. The Future of Rotation and Investment Strategy

• Looking ahead, as interest rates normalise, sectors like small caps and value stocks are expected to do well.

• Long-term forecasts predict that US growth stocks may underperform compared to value stocks and international markets.

TRANSCRIPTION

THE GREAT STOCK MARKET ROTATION – WHAT HAPPENS NEXT

1. Introduction: Understanding Stock Market Rotation

• Global stock markets have seen little overall movement recently.

• Beneath this calm surface, significant shifts are happening within specific sectors.

• Rotation refers to some sectors rising while others fall, despite overall market stability.

Global stock markets have been moving sideways for several months without a convincing move up or down. That masks large movements beneath the surface as the nature of winning and losing stocks has changed quite markedly. In this piece, we look at what has changed, why and whether I think it'll continue.

Let's begin by what we mean by rotation. This is a situation in which the market overall doesn't move a huge amount upwards or downwards, but under the surface, what's happening is that subsections of the market are aggressively moving up and down. So that could be particular sectors, or it could be a style of investing, and in this case it's actually both of those. A visual metaphor which people often use, is current underneath the surface of some still water - the surface looks calm, but underneath there's some kind of whirlpool going on, so there's a sense of masked turbulence.

That's all very well if you've got exposure to the index as a whole, you don't really care. But if you've got exposure to any of those tilts, factors, sectors, then you can be swept away.

2. Example of Rotation in Action

• Over the past two decades, growth stocks, especially in tech, have outperformed value stocks.

• Two ETFs (IVW for growth, IVE for value) illustrate how growth has generally led over the long term.

• Recently, this trend began to reverse, particularly after July 11th, 2023, with US inflation data publication.

So let's look at what's happening right now, and I think it pays to zoom out a little bit so that we set up to see the recent changes. The trade, which has worked incredibly well for two decades now, is simply to buy US large cap growth stocks. Let’s for example, compare 2 ETF's. The first one is IVW and that is a growth ETF, so it takes a subsection of the S&P 500. These are stocks whose earnings, their profits, are expected to grow much more rapidly than the S&P 500 as a whole. Contrast that with IVE, which gives you exposure to the value part of the S&P 500. So these are companies which are undervalued based on some valuation measure like price to earnings. Or price to book ratio. Then sandwiched in the middle of those two, the blue line is the S&P 500 and that's got a return which is somewhere between the two.

Now if we look back much further over a century say, value is the factor which has worked very well in the past. You buy cheap stocks, you wait and they outperform. Over the last two decades, however, - much of which has been a 0 interest rate period - that's not been the case. It has been growth which has beaten value. That's not to say that value would have been a disaster. It wouldn't have been. You'd have got 6.2% annual return, which is pretty good. But if you had gone for growth over that 20 year period, you'd have beaten value by 2% per year - a huge amount compounded over that two decade period.

3. The Shift in Sectors

• Post-inflation data, tech stocks began to falter, while value stocks, like real estate and utilities, surged.

• This was a reaction to changing interest rate expectations, favouring sectors more sensitive to interest rates and the cost of money.

But what's notable is that the world pool - the factor change, the rotation if you like - started on July the 11th of this year. That was the publication of US inflation data. Now, this happens on a monthly basis, and it was this inflation print which pushed the market expectation about the first rate cut from the Fed from 50% to above 90%. So if I read what the FT said about that the next day, it said:

"US tech stocks fell while small caps surged, in late morning trade in New York, following cooler than expected June inflation data".

So the NASDAQ fell 1.2% with all of the Magnificent 7 tech stocks except Tesla in negative territory and NVidia was down 3%, Meta 2.1%, Microsoft 2.5% while the overall benchmark S&P 500 only fell 0.5%. So the move under the surface was triggered by this new inflation data.

So if we follow those two ETFs, value and growth, through this, after that tech peak, notice how Value carries on trending upwards whereas Growth very much moves in the opposite direction, while the overall S&P 500 is sandwiched in the middle and hardly moves either way.

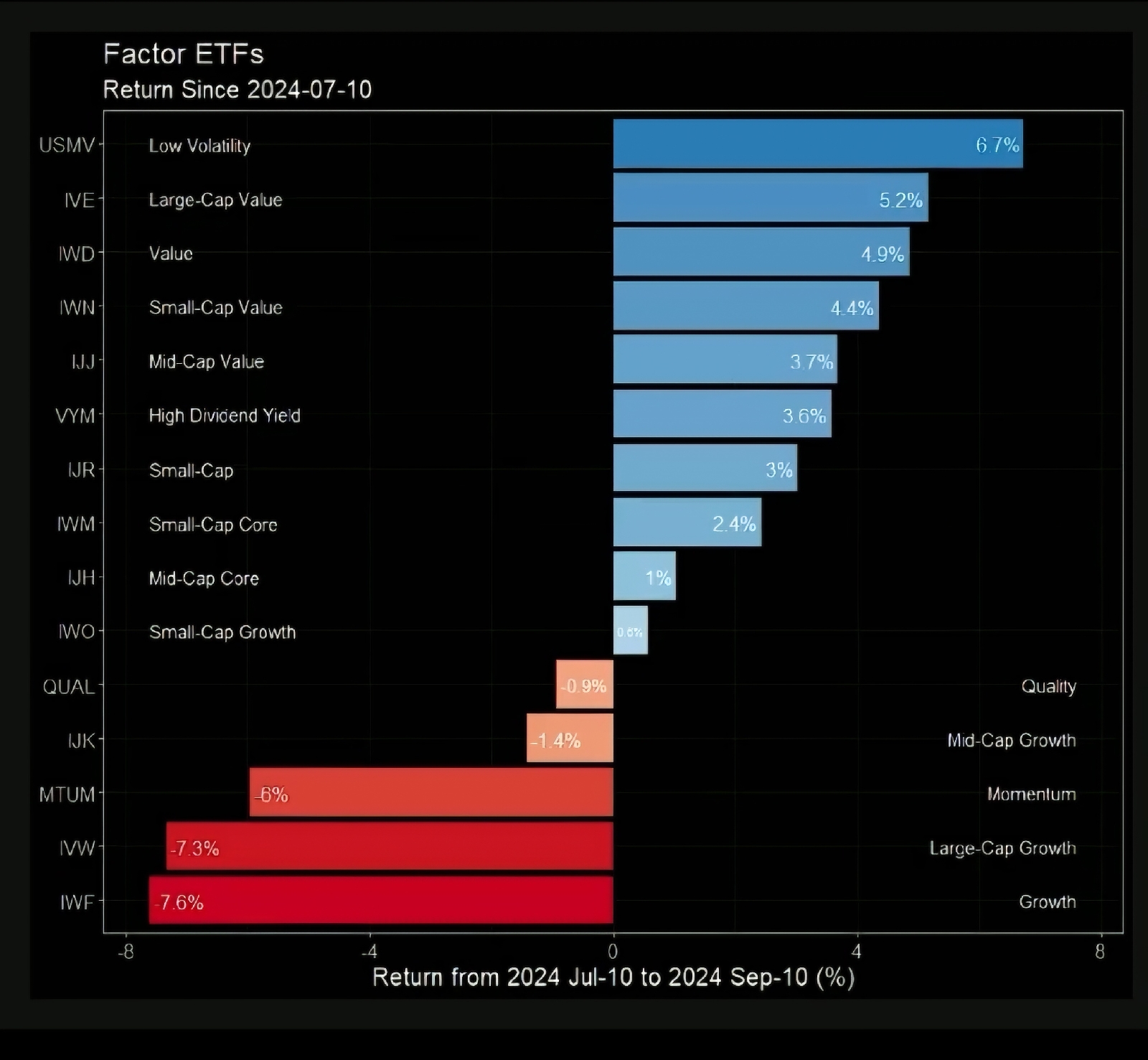

Let us broaden the factors that we now look at. We've got small cap growth, small cap value, large cap growth, large cap value and also the blends in between. Notice how the factors at the top of the table with the greatest returns since that peak have been the value flavours of the S&P 500. So that's large cap value, value blend, and also small cap value. The ETFs at the bottom of the table are all growth.

If we slice the US market according to sectors – “sectors” is labelled “industries” in the US - notice how Tech comes at the bottom of the table. Tech was down about 12% over this two-month period, whereas the sectors at the top of the table are interest rate sensitive sectors, things like real estate, which was badly beaten up when interest rates were very high, but also quite boring defensive sectors like utilities, consumer staples and even healthcare.

So while the SNP hasn't been moving that much, you can see that if you look at sectors, if you look at styles of investing, things have been moving very rapidly and also changing direction compared to this two decade trend that we'd seen.

4. Why Rotation is Happening Now

• US mega-cap tech stocks have been significantly overvalued.

• Investors overpaid for stocks driven by narratives like AI, while fundamentals are starting to reassert themselves.

Why is this rotation happening in the first place? In fact, I think the question should be turned around. And I'd say why hasn't it happened sooner?

The reason for that is that if you look at the very large mega cap tech stocks in the US, they have been hugely overvalued relative to the rest of the index here. For example, look at the forward price to earnings multiple – this is the number of dollars investors are willing to pay for every dollar of forecast profits. In the case of the Mega Cap 8 - so that’s Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, NVideo and Tesla - strip those out of the S&P 500 and look at the remaining stocks, and you will notice how much that pushes down the overall valuation of the index. We go from about 29 times forward earnings, to about 19 times forward earnings.

So why would people be willing to pay more for every dollar of profit from one of these tech companies, than they would from other stocks in the S&P 500? Well, it's a fashion and it's also a sense of euphoria and it is a phenomenon driven by a narrative. A lot of that narrative is to do with AI. And I think what's happened is that people have overpaid for those stocks because of that narrative. But narratives are fickle, whereas fundamentals are very reliable in the sense that markets snap back to fundamentals when some kind of shock comes along.

In this case, I think the shock has been a macro-economic one. Which is that we've gone from a high rate environment to something which is more like normal rates. We've gone from an inverted yield curve and we're about to move to a yield curve which is upward sloping. But whatever the trigger would be, whether it's a macro shock or a scandal, eventually this was going to correct one way or another.

Another imbalance which I think is interesting to look at comes from comparing the proportion of profits which those eight stocks account for in the S&P 500 and the proportion of revenue, and contrast that with the percentage of this market-cap weighted index they make up. So currently they make up 30% of the total market cap of the index - let's call it a third of the overall of the S&P 500, which is very high by historic standards, its valuation is very concentrated in the Mag7 stocks. And at the same time they only make up a fifth of the profits generated by the S&P 500 and about a ninth of the overall revenue. So they are certainly punching above their weight, fundamentally, in terms of the proportion of the overall index. This is a situation which can't persist forever.

The other point is that if you look at the S&P 500 overall, it's full of great companies. They're not necessarily anything to do with AI, but they're profitable. They've been growing their earnings, they've got good strong balance sheets and these are quite. unsexy companies. It's really hard to get worked up about a company like Walmart, or Johnson and Johnson, or Coca-Cola (one of Warren Buffett's favourites). Whereas Alphabet, NVidia, Broadcom, all of those stocks have been very much driven by this AI narrative.

So I think what we're seeing here is simply a recognition that those are good companies, even though they haven't been very sexy, and the rotation towards value is a nod towards those healthy companies which are simply undervalued.

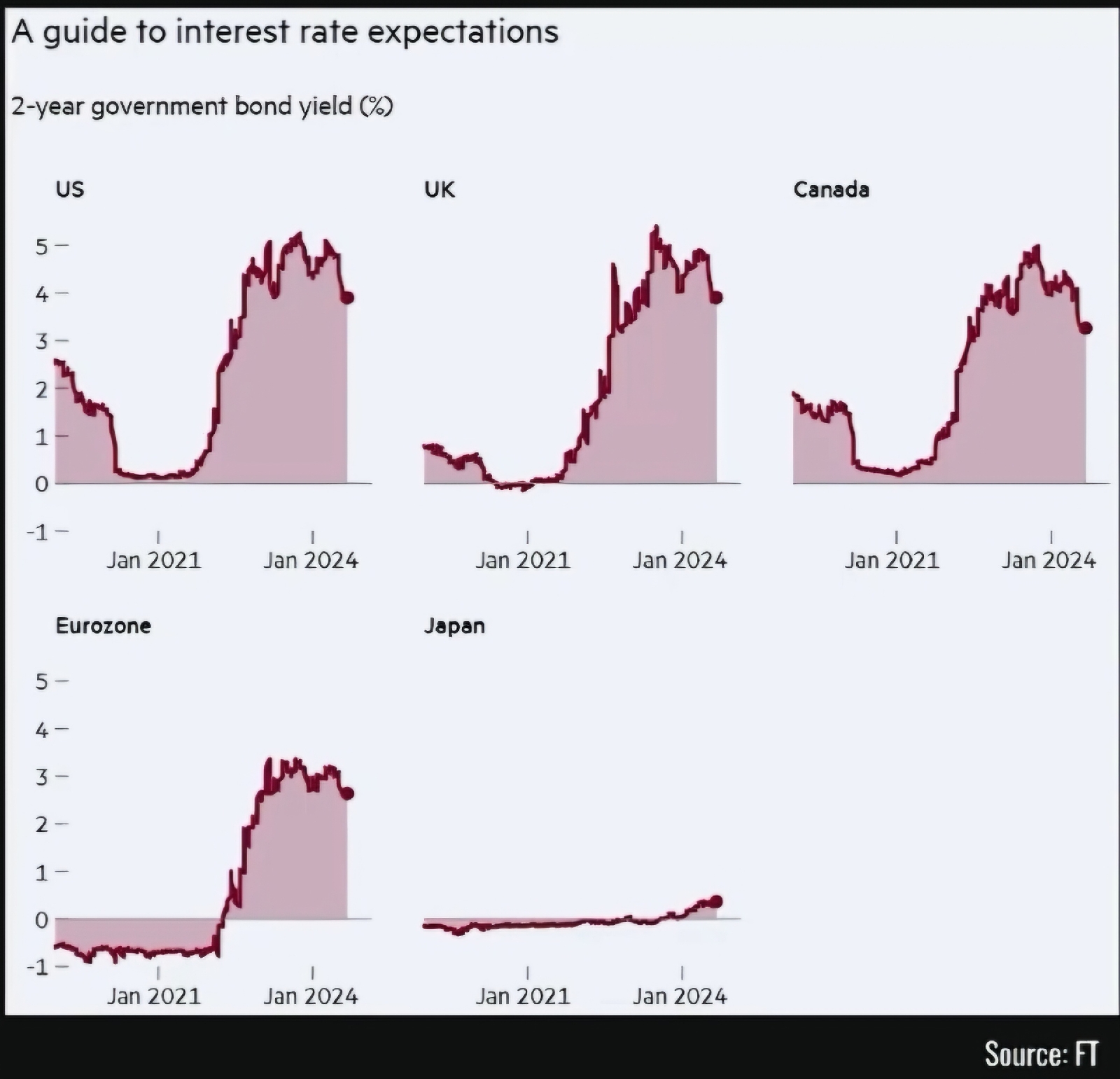

So now let's think about what could happen next. If I had to characterise 2024 - and I think this is the way people will look back on the year in future - it's the year in which the Fed started to cut interest rates after successfully battling inflation. It's not just the Fed that has been battling inflation. All other central banks have been doing the same thing at pretty much the same time. But if we look at interest rate expectations for the rest of this year and the two year yields from various countries, this give us a hint about what markets are expecting with the policy rate changes. Notice how for every country other than Japan, those two year rates are at pretty high levels because that reflects the high policy rates we've got at the moment and they're expecting cuts. Notice how they've started falling in almost all of those countries except Japan.

This big macro shift from inverted yield curves, restrictive monetary policy, going to a more normalised policy, upward sloping yield curves, is a huge shift that affects the cost of funding for companies and it affects risk appetite. Over the short term what we can expect to see is an extension of the rotation we've seen already, which is that interest rate sensitive sectors like real estate, like small caps, where there's a lot of financials which have lent money to the real estate sector, those stocks and sectors will see a boost as interest rates start to fall.

However, interest rates won’t fall to 0. The expectation is that interest rates, the policy rates, will fall at least to around 3%. It looks like we're going to get a soft landing. In other words, no huge recession.

So for small caps is looks pretty good. I'd expect small caps do pretty well over the medium term. And that's going to be boosted by the huge valuation disconnect between small caps in the US right now and large caps. I don't think I've ever seen such a large difference between the valuation of the two. The small cap S&P 600 index is trading at a multiple of 14.5 times, versus 20.2 times for the S&P 500. So I think we will see that differential normalise and I think rates will probably be a trigger for that.

5. The Future of Rotation and Investment Strategy

• Looking ahead, as interest rates normalise, sectors like small caps and value stocks are expected to do well.

• Long-term forecasts predict that US growth stocks may underperform compared to value stocks and international markets.

Equities 10-year return and volatility expectations

But how about over the longer term, once rates of normalised, what then? And here I think valuations will still matter and that's because we still see US tech stocks and growth stocks as having particularly high valuations relative to the rest of the US market and the US market relative to the rest of the world. And in this respect, it's interesting that Vanguard has just published its 10 year outlook for various stock markets around the world. Notice how for US growth stocks, the outlook is particularly poor - it is between 0.1% and 2.1% growth every year for the next 10 years. Contrast that with US value which between 4.7 and 6.7% per year. Small caps between 4.8% and 6.8%. And looking outside the US, we're looking at between 6.9% and 8.9% for non-us stocks.

The reason for those forecasts is that US growth is just overpriced. People are paying too much for growth right now. The penalty which they'll pay for that if they stick with that tilt is simply underperformance relative to those other sectors and countries which are not so overpriced. Now of course, we should always take these forecasts with a pinch of salt. They're always wrong. But there are interesting findings and I think they reflect those valuation disconnects that we're looking at right now.

As index investors, you could look at these rotations under the surface and just be bemused. Some people continue buying more tech stocks because that's what's worked over the last two decades. They assume that that trade will carry on working. But I think that's a pretty dangerous thing to do, doubling down on this huge concentration that we already have if you own a global index, say.

So I certainly wouldn't do that. Mind you, I wouldn't tilt away from the US - I still think it's got very good returns that it can generate in future. But I think that the benefit of being globally diversified is that you're not going to be that concentrated in one country. And if there is a correction in the US, then at least you'll have that non-US allocation as well to soften the blow, but it could be that US growth continues to outperform. So I probably wouldn't take a huge tilt one way or the other. But certainly in my personal portfolio I've taken a tilt to US small caps and also UK small cap, growth, value, quality stocks, because I think valuation long term does matter.

No comments:

Post a Comment